Short ramblings on four nordic nano medtechs

$contx.ol $pax.st $pho.ol $clbio.st

Spontaneous ramblings about some Nordic medtech nano-caps that I’m following / own in PA. I’ll keep it short and incomplete — just some recent thoughts that passed through my mind, tailored to the attention span of a five-year-old.

Contextvision $contx.ol (4.85 NOK/share, 375mNOK mcap)

Swedish Hidden Champion (listed in Norway) in medical image enhancement software. Profitable, scalable, excellent cash conversion, long and stable organic growth. Very conservative accounting.

Behind this graph hides a completely failed bet on digital pathology (spun off). That vertical was also the main long thesis among Nordic investors a few years back, now this Co. is left for dead. Note how topline is ~unaffected during the pandemic.

Main bear thesis: Restricted TAM, reliance on OEM customers that could go in-house, questions around actual need/clinical utility of the software.

So what do they do? They try to find new verticals. Enter “point-of-care-ultrasound” (POCUS), which they recently changed to refer to as “Data Quality”. Already here I start to get hesitant. This whole vertical is vaguely defined in their communication, spanning across “organ-specific applications” with the help of imaging enhancement, AI and digital biomarkers for early disease detection and monitoring. They aim to put ~10% of top-line into R&D on this vertical. Last Q, they were at 7% (climbing steady each Q). Hence, margin pressure. Increasingly so. It’s usually not fun to own a Co. with decreasing profitability.

We have several further issues here:

Zero visibility on the “Data Quality” endeavor, unknown time-lines, unknown total costs, impossible to judge potential

Listed on disliked Norwegian exchange (despite being Swedish)

Over-promise and under-deliver, they have “promised” POCUS collaborations/contract agreements several times with repeated missed deadlines.

Non-shareholder friendly communication from mgmt. (take a look at how they present the sales development, almost like they want the share to trade lower)

Fund out-flows (9.4% → 4.5% last 18 months)

Why would you own this when you can’t see the end of the tunnel? because you’re a hopeless bottom-caller.

Now, I wrote all above before Q1 (ended the text on a positive note and citing aligned incentives with the new stock comp plan, buyback mandate and a very rare founder purchase).

Then Q1 happened, and I blinked in total disbelief. A complete train wreck of a quarter. And more troubling, that amazingly stable business all of a sudden had a drop explained by “seasonality” and the following sentence “and an unfavorable ultrasound customer mix as new platforms, in which we are not yet integrated in, gained market share.” If that wording doesn’t scare you off, I don’t know what will.

I have to go back far to find a quarter with negative op.income. POCUS as a percentage of net sales isn’t even disclosed in the report anymore.

BIG question now if this was a mere hiccup or if the legacy business is showing initial cracks before falling apart. Or, as a tin foil hat wearer would think - a deliberate strategy right before the baseline is set for the incentive program that is based on share price development and EBITDA from here until 2027.

I don’t know, I still own some. I did puke out some shares on the Q1 numbers. We are now trading at trailing ev/fcf ~10x, but steadily increasing as R&D costs increase (and as of Q1, top-line doesn’t hold up).

Paxman $pax.st (83.6 SEK/share, 1928mSEK mcap)

Global leader (well now more or less the only actor) in scalp cooling. You put a cooling cap on your head during chemotherapy administration to avoid losing your hair. The cap is connected to a machine the size of a small refrigerator that is located in the infusion suite. Paxman has already a large number of machines in place across the globe. But particularly, US is the investment case here.

This one has finally started to work share-price wise the last year.

I think the real “unlock” was the progress on profitability and clear demonstration that the company is self sustained and can scale. Classic profit inflection point, exactly where you want to be. Add some key developments in the administrative/reimbursement landscape (e.g. CPT Category I code). In the wake of this, the company has started to attract serious institutional interest, and been able to place/offer shares successfully.

Reimbursement is key to achieve higher utilization (if you run the math on potential recurring revenue per year from the installed base, your Excel explodes). Things are improving, but still has a long way to go. Mgmt. has talked about a ~3-4x increase in utilization on average for customers that have adopted the new billing system. Add to that an estimated higher price level in the wake of CPT 1 codes effective Jan 2026.

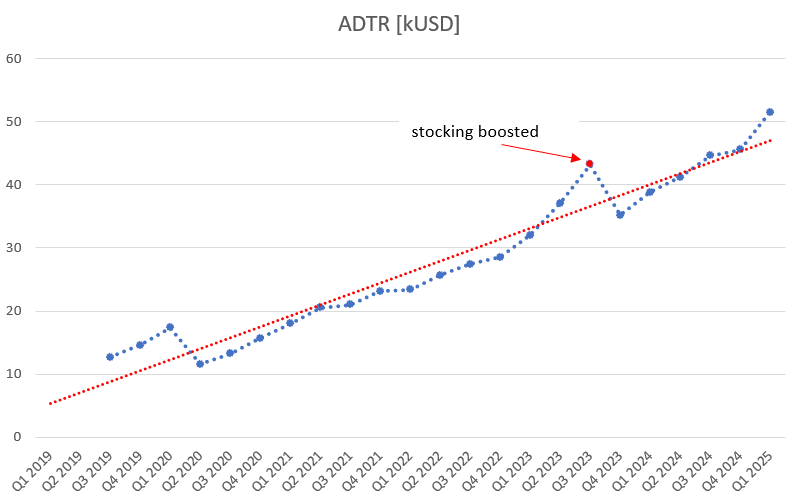

Average daily treatment revenue (ADTR) in a chart:

Steady progress

In March, Paxman announced the acquisition of Swedish main competitor Dignitana, essentially turning the scalp cooling duopoly to a monopoly. Dignitana has been less successful than Paxman, especially the last ~4-5 years, in the end reaching net sales of about a third of Paxman’s. They do however have almost ~50% of Pax number of US customers, and an installed US base of 459 systems vs Pax 1200. The transaction valued Dignitana to ev/s x1.7 (compared to Pax value at the time of 4.6x). I think Pax could have starved them out, but didn’t want to wait any longer as they wanted that customer base ready when they are about to roll out their next growth pillar, which is a cryocompression system for prevention of Chemotherapy Induced Peripheral Neuropathy (CIPN). So, we’re about to cool all kinds of body parts in that infusion chair.

Take that increased customer base, increase the utilization as well as the price per use. Add CIPN upsell. You get the idea.

Paxman now trades at ~1.9bSEK mcap, ~5.5x sales, with profitability taking a hit with loss-making Dignitana turning ebit ~flat (?). I think the acquisition is excellent longer term.

Near term (9-12m) I see an increased risk of;

Post-merger integration challenges

Fx-related headwinds (USD weakness)

Initial proposed reimbursement levels for new CPT Category I codes (July 2025), the initial proposal often undercuts the final levels - risk for disappointment in the eyes of the market?

(Overly) ambitious CIPN roll-out plan with delays

Vs a year ago, I think the potential is even greater today, but the risk has also increased shorter term.

Photocure $pho.ol (51.5 NOK/share, 1398mNOK mcap)

Sole provider of the imaging agent needed for blue light cystoscopy. Tons of data out there demonstrate the superiority of BLC in terms of detection and recurrence rates, although stubborn voices still exist that demand further overall survival data. Main issue though, is that the procedure introduce several levels of complexity and costs.

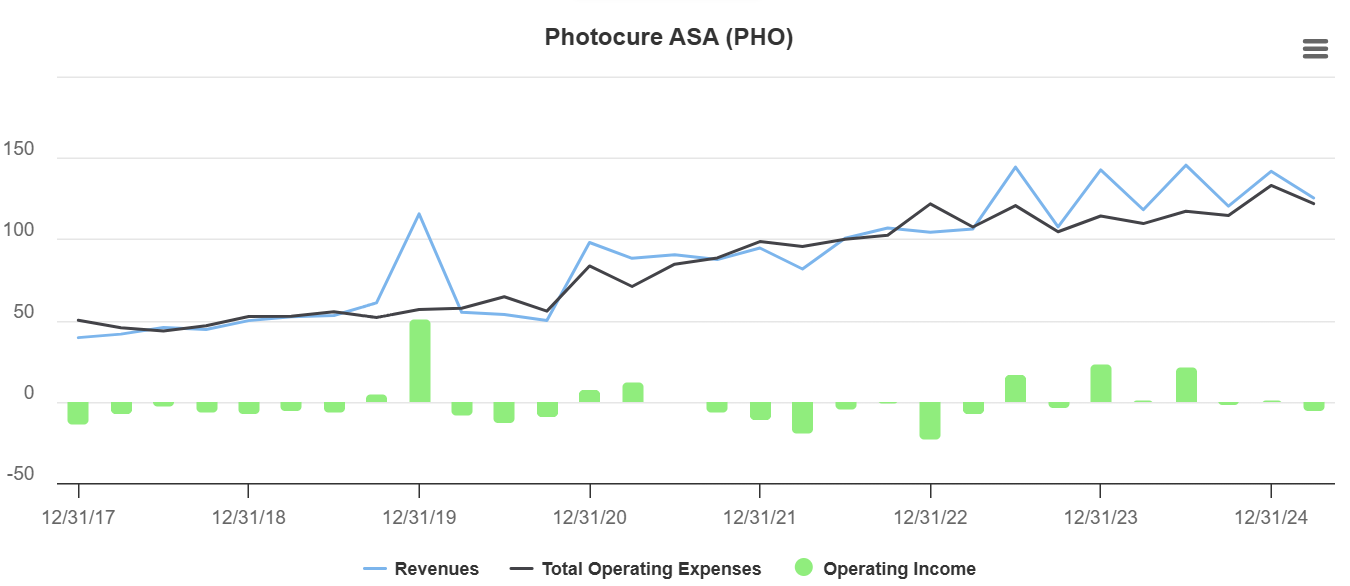

This one has been a very frustrating equity story. In theory, is should be able to scale with their ~94% GM reagent. But it just doesn’t;

However, there are stuff below the surface that could make that graph look worse than it is. Production of the current flexible BLC equipment by Karl Storz—the main supplier—was discontinued in 2023 due to component supply issues. Turned out to have been a way larger headwind then I initially realized, clearly affecting top line growth since.

It just doesn’t help that the Co. have a history of overpromise and underdeliver. Such cos have a tendency to be affected by new headwinds constantly…

Karl Storz is also the only FDA-approved supplier of rigid blue light cystoscopy (BLC) towers in the US. This is a class III device, and there is an ongoing Citizen Petition to reclassify the device to Class II (which would turn it into a 510(k) pathway for others). That CP is in its 3rd year or so. God knows when it will eventually reach a decision. A re-class to II would be a major event for Pho, as it would/should significantly increase the availability of scopes in the US (other big actors are currently pushing new systems in other geographies).

Net cash of ~260mNOK. Trading at ~2x ev/s, with ~94% GM, HSD revenue growth. Bottom line ~break-even. One would think that someone would just scoop this thing up, plug it into existing sales force and the purchase would pay itself off within 3 y. But it’s that thing with a drug-device regent, it doesn’t really fit that many org.

As time goes on, the case is more and more turning to that “optionality” being “Cevira”, a non-surgical treatment in development for high-grade squamous intraepithelial lesions (HSIL) of the cervix. That one is licensed out to Jiangsu Yahong Meditech Co Ltd, a Chinese Co. where this product is a key asset after some other pipeline failures.

The potential Chinese approval of Cevira in Q3 2025 would infuse a ~120mNOK milestone payment into Pho. Further sales milestones and tiered sales royalties of 10-20%. Based on Jiangsu Yahong’s own talk that could be substantial for Pho, but I think the real kicker would be if the Chinese could find a US partner (royalties to Pho transfers) - which they are actively pursuing. A bit of a odd product but data looks decent in my mind, so maybe they could find someone willing?

Changes in the board speaks for improved shareholder-friendly activities, and at the recent AGM, an expanded buyback authorization of up to 10% of the share capital was passed. They could very well make that entire purchase with cash at hand (~150mNOK). Co. is basically overcapitalized after that potential Cevira milestone.

Corline Biomedical $clbio.st (9.7 SEK/share, 238mSEK mcap)

Smallest Co. of the bunch, offers surface coating solutions for the medical device industry and regenerative medicine. They did a pivot in their strategy last fall, fully focusing on the Medtech vertical and pausing all activities related to (capital burning) pharmaceuticals. That transition made it much more interesting in my mind.

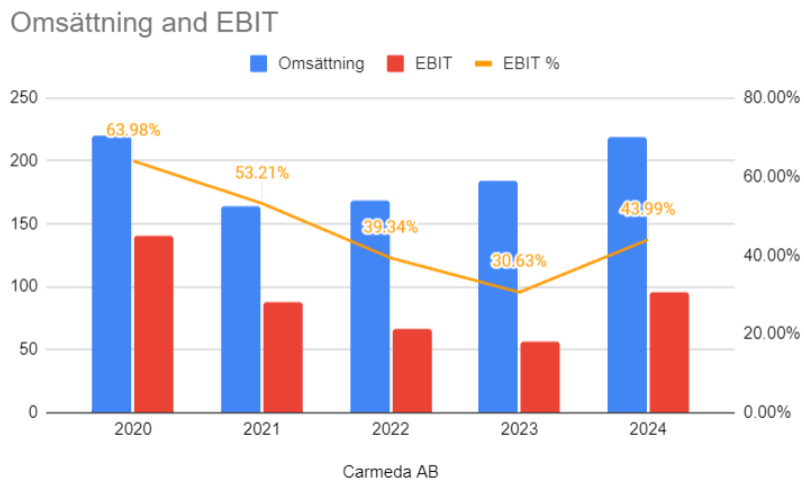

There is another private Swedish Co, Carmeda AB, which originates from the same lab (under different IP) as Corline, running pretty much the same business successfully with a great margin profile;

Sorry, I’m lazy, “Omsättning” = revenue.

That is the poster child of what this could look like. A publicly listed Carmeda would probably trade north of 2000mSEK. Corline has 10 or so projects with medical device companies, but there is one that is way ahead in maturity which is approaching commercialization, being Canadian Kardium Inc.

Kardium has developed a device in one of the hottest field in Medtech right now, pulsed field ablation (PFA), a new ablation technique to treat atrial fibrillation, a common heart rhythm disorder.

This field is currently dominated by Boston Scientific, but all usual suspects have recently entered or are about to enter. Consensus is that PFA will in large take over the ablation market, ball park figures of >$5b in a couple of years with high growth.

Now, if we run some simple math. With a license fee of 3% to clbio (this is not disclosed, but a industrial average), a 5% market share to Kardium at 2026 numbers, would imply ~70msek to clbio. Substantial for a 240m Co. and well past what’s needed to turn profitable (annual opex of ~20m or so).

Now, this is starting to sound like the classical “if they just take 1% of the market it would … “ or my old favorite “there are xxx horses in the world, they need 2 doses per year, that equals to …”

Do Kardium have a device that could actually take some market share here?

What we can say is that their device is good at pulmonary vein isolation (PVI). In fact, it’s excellent at it. I was very cautious to read to much into their EU study results, which was single-center, low n’s / wide confidence-intervals and performed with experienced operators. Such data could easily fall apart when transitioning to a multi-center study with first time operators.

However, in late April they presented data from their pivotal US study, AF-free rate ~78% (only paroxysmal cohort), with 95% durability on a per vein basis, and only 6% had repeat PVI procedures. Almost zero safety events. Best-in-class numbers. AF-free rates about ~80% is probably more or less the ceiling of how far could you can get with “perfect” PV ablation.

This thing appears to be some kind of ablation connoisseur choice. You get contact confirmed feedback, you see the vein and can really push up against it, knowing exactly what you’re doing before firing. However, its large size and geometry limit maneuverability, especially in complex/small anatomy.

Thing is, docs are already very good at PVI with existing equipment. You have established, very large actors that dominate a hot market where a new entrant with zero former presence will try to make inroads. That is a very tough spot. Can you compete on price or speed? Probably not.

Kardium is currently doing (or so I’ve heard) a capital raise, FDA submission late last year would set them up for a potential h2 launch. Current site in Vancouver have 50k capacity, or devices for ~$500k/y revenue. IMO, dream scenario for Corline would be that a larger actor with muscle acquire the Canadian.

Welcome back!